What to Know, Now

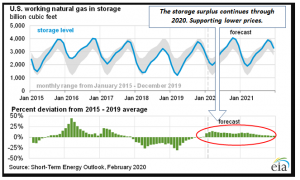

Supply and demand in the wholesale natural gas market impact electric and natural gas prices across the country. The U.S. stores natural gas to ensure we have an adequate supply for the winter; thus, the amount of available stored gas affects the market. Natural gas is also the primary fuel for electric generation, so its price directly impacts electric rates. Currently, storage levels are 31% above last year’s volumes and are continuing to put downward pressure on prices, bringing prices to historic lows. Here are a few key points worth noting at this time:

The Bottom Line: Midway through the winter, consistently mild temperatures in the east have increased storage levels and brought natural gas prices to record lows. 2020 NYMEX prices are mostly below the low benchmark rate of $2.50/DTH. These low prices may remain until the storage trend reverses with higher demand or lower production levels. Adding to this slowing market is the expected coronavirus impacted reduction of LNG shipments to support manufacturing in China. All these factors support extended lower rates for natural gas commodity. It is a very good time to review fixed price contracts for future cost reductions.

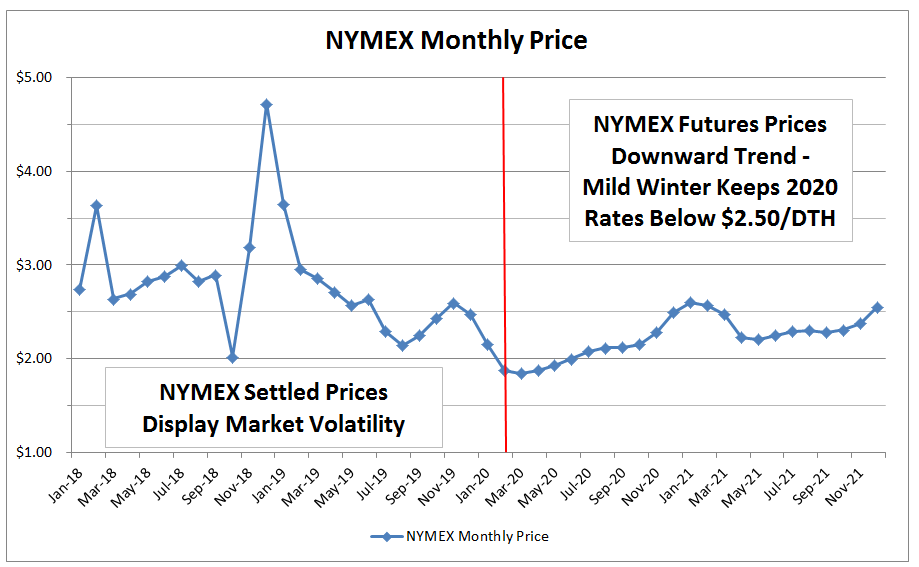

NYMEX natural gas prices have dropped significantly over the past six weeks with improving storage levels. The chart below displays the NYMEX Natural Gas Futures price history and forward rates, illuminating the volatility of the past and the lower rates in the future. Overall, prices remain relatively low and still represent good buying opportunities.

NYMEX Natural Gas Futures – Historic and Forward Prices

Natural gas storage levels have increased over the past few months and are forecasted to remain with a substantial surplus into 2021. The surplus stored gas will continue to put downward pressure on prices.

Natural Gas Storage Status – Historic and Forward Stored Levels

For those of you who have contracts expiring in the next few months: this trend has created an excellent opportunity to lock in low priced fixed supply.

Customers who are on index pricing are also seeing very low rates at this time. We expect these prices to remain low until extended cold temperatures arrives. Winter index rates are expected to be high with pipeline constraints adding costs during high demand periods.

What to Know About 2020

The increasing natural gas surplus is expected to keep NYMEX prices from rising this year. The storage trend may be reversed later this year if there are production decreases or a hot summer triggers high demand for electric generation. Fixed prices remain attractive, and index rates will continue to susceptible to seasonal increases (high winter gas and high summer electric).

What To Do Now

Prices are currently very low for natural gas and but higher for electricity in some markets, such as New York. If you have accounts on utility supply or a variable rate, this is a good time to consider moving to a fixed rate.

Market Prices

NATURAL GAS

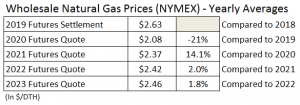

Wholesale Market: Current 2020 NYMEX prices are 21% lower than 2019’s average prices, and 2021 prices are 14% above current 2020 rates. Declining prices in the NYMEX Futures market create lower fixed price contract rates and are an indicator that the market expects future prices to remain low. Basis transportation costs remain high and will make heating accounts much more expensive than level usage non-heating accounts.

ELECTRICITY

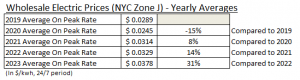

Wholesale NY Market: Prices have been kept lower by the softer natural gas market, but in New York City, electricity prices in future years are much more expensive as environmental laws and the closing of Indian Point Nuclear Plant are impacting future supply rates. From 2020 to 2023, there is a 54% increase in electric price.

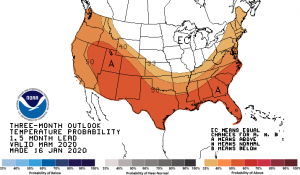

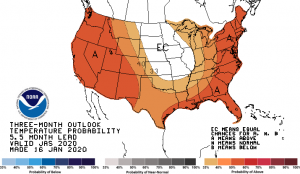

Temperature Probability Maps

Current temperature forecasts for the remainder of 2020 are calling for above-normal temperatures across most of the United States. These temperature trends are expected to keep heating demand low, but electric generation high. The net cost impact will depend on a continued storage surplus of natural gas, but short term spikes should be expected in markets with limited or constricted supply.

March/April/May 2020 July/August/September 2020