May Market Conditions: COVID-19 Impacts Energy Markets with Price Volatility and Uncertain Future

What to Know, Now

Currently, the decline in energy demand from the COVID-19 virus and the recent mild winter temperatures have softened energy prices in the near term with many questions remaining concerning future energy demand and prices. It is generally expected at this time that the restarting of economies around the world will be slow and measured and that economic conditions globally improve over the next 18 months.

Natural Gas

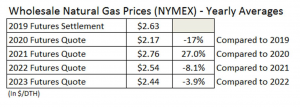

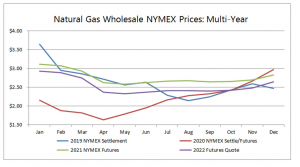

Stored natural gas is currently at surplus levels with production still outpacing demand, keeping downward pressure on prices. With the crash of crude oil prices into the negative range in April (a first), producers have begun shutting down less productive wells, which is also reducing some natural gas production and is putting upward pressure on winter natural gas prices. Despite that, winter natural gas rates are currently within a typical winter cost range. The table and chart below show the pricing trend from 2019 to 2023, with lower rates in 2020 and increasing costs into 2021.

Electricity

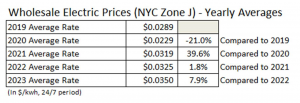

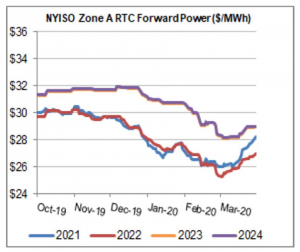

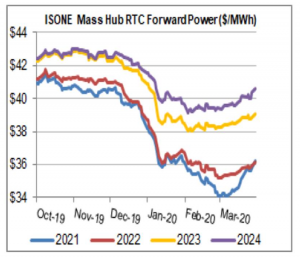

Since the price of electricity generally moves with the price of natural gas, the two prices have similar trends. Electric rates are now fairly low, but with expectations of increases with hot summer weather (as forecasted) and in winter with the higher natural gas rates. Price trends vary from state to state, but generally, prices are increasing each calendar year.

The Bottom Line

This pricing trend typically creates lower fixed price rates for the longer term (two and three-year) natural gas contracts and higher fixed contract rates for the shorter-term (twelve-month) natural gas contracts with 2021 usage. Variable rates that move with the market may be lower at this time but are susceptible to increases with the arrival of summer.

Winter focused heating accounts will see a slight cost reduction in 2020, while accounts with steady year-round demand (such as heat and hot water accounts) may see lower costs this summer and more favorable fixed contract rates. If you rely on fixed-price contracts to control budgeted costs, this is an excellent time to review the impact of your next contract. Not sure what your options are or how to proceed? Bright Power can help.

The current pricing electricity trends create higher fixed contract rates for longer terms but offer price stability during volatile periods such as this summer and next winter. Since energy costs vary in each state it is best to validate any savings opportunities with refreshed pricing on your next supply agreement.

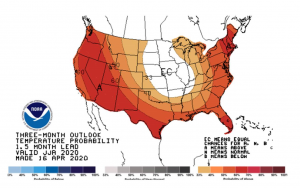

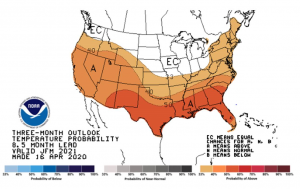

Temperature Probability Maps

Current temperature forecasts for the remainder of this year are calling for above normal temperatures for most of the U.S. These forecasts will likely continue to support market price volatility as a hot summer can trigger high electric and natural gas usage and rates, while a mild winter could reverse that natural gas winter demand causing prices to decline.

Summer 2020 Winter 2021