March 2019 Energy Market Update

The Bottom Line

Winter will end this month with natural gas storage levels at a five-year low, 32% below the five-year average. The large storage deficit means that energy prices will likely see a return of volatility, especially if we have a hot summer with high energy demand. Reminder: natural gas is also the primary fuel for electric generation, so its price also directly impacts electric rates. Thus, a hot summer is likely to mean less gas going into storage, and a continued deficit and price uncertainty into 2020. Be prepared: weather driven price changes and high summer heat could impact winter prices.

What You Need To Know About The Rest Of 2019

We are currently in a favorable period for buying energy as we approach the “shoulder months” of spring between winter cold and summer heat. Prices for fixed-rate contracts are lower than 2018 for many accounts and make this a good time to review supply contracts. If this summer is as hot as forecasted, electric prices may rise and natural gas storage growth would slow, all leading to potentially high prices next winter. In the NYC market, we are now seeing natural gas fixed prices below $0.50/therm and electric rates at $0.065/kwh.

Unsure if now is a good time to lock in? Our energy markets experts can help you understand current rates and make recommendations based on your tolerance for risk.

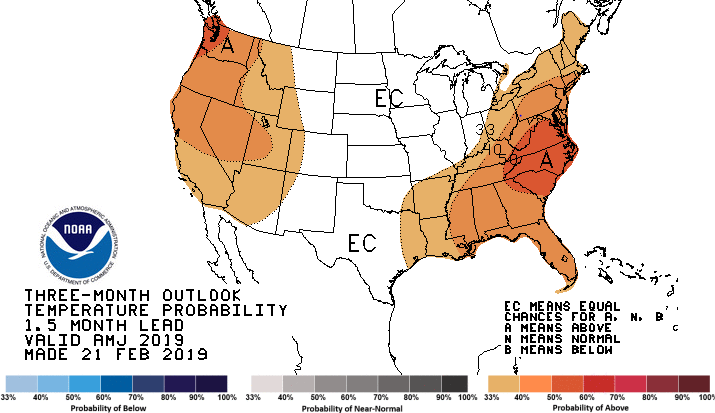

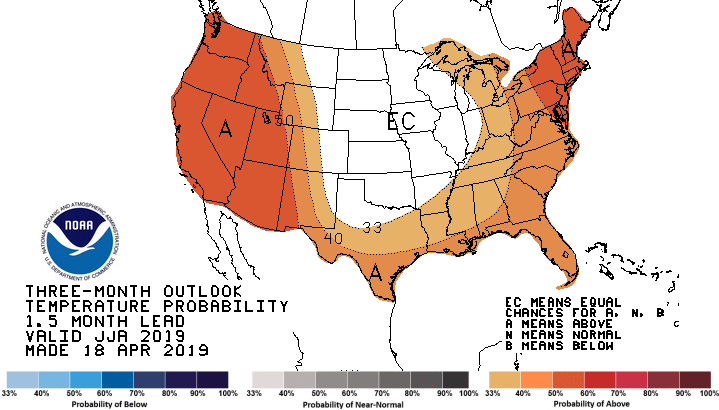

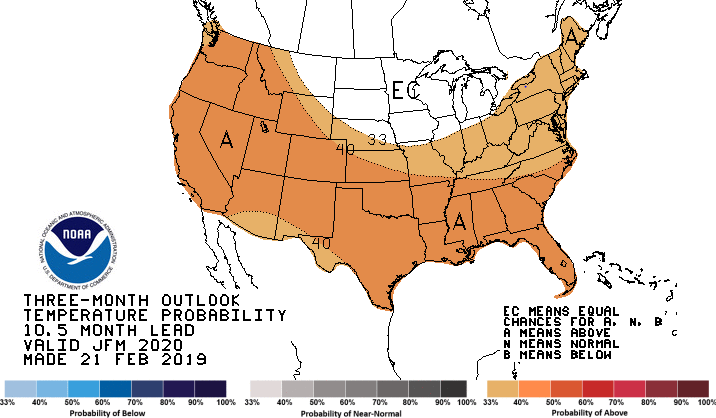

Temperature Probability Maps

As winter comes to an end, forecasts for the rest of the year are calling for mostly above normal temperatures. If these forecasts hold, we could see high air conditioning demand slow down natural gas storage and push up prices. The higher prices could easily continue into 2020. Conversely, if temperatures are mild the high production levels of natural gas could allow for improvements in storage and softening of prices.