The Climate Mobilization Act passed in New York City Council on Thursday, April 18, and is now law. There are eleven pieces of legislation that are part of the Act, but the centerpiece of this legislation is a carbon emissions limit for large NYC buildings (formerly Int. 1253, now Local Law 97)—placing requirements and also presenting opportunities for NYC’s building owners. You can read our analysis on the impact of multifamily buildings.

We’ll help you with what you need to know. The questions below are related to the carbon emissions limit law unless noted otherwise. Submit your questions and continue to refer back to this blog, as we’ll update it regularly.

Who does this law impact?

What does the law say?

What date does this go into effect?

Does a building have to make changes in order to comply?

What should building owners do today?

What kinds of fines can I expect if I can’t reduce my emissions below the 2024 and/or 2029 limits?

I have to make at least some substantial improvements to get into compliance. How will I pay for them?

What kinds of improvements will I need to make to reduce my carbon emissions?

What are the prescriptive measures for rent-regulated buildings?

I read the legislation, and there’s a lot of ambiguity. What does that mean?

How does this relate to building energy grades (Local Law 33)?

How does this relate to other energy reporting requirements (i.e. the benchmarking required in Local Law 84 and 133)?

How does this relate to the energy audit and retro-commissioning law (Local Law 87)?

I’m in the process of designing a new development. What’s new that I need to take into account?

What does the “Green Roof” legislation (Local Law 92/94) entail?

Who does this law impact?

All buildings over 25,000 square feet in total floor area and two or more buildings on the same tax lot that together exceed 50,000 square feet (including condominiums and cooperatives) must adhere to the law, although certain buildings have alternate requirements. It is important to note that today, 75-80% of all multifamily buildings are already in compliance with the first carbon emissions limit deadline.

Buildings that have alternate requirements include:

-

- HDFCs

Buildings that do not currently have any emissions limits or prescriptive measure obligations under this law:

-

- Houses of worship

- City-owned buildings

- Multifamily properties that are three stories or less with no central HVAC systems or hot water heating systems

- Industrial facilities primarily used for the generation of electric power or steam

- Buildings owned by a limited-profit housing company organized under article 2 of the private housing finance law (Mitchell Lama)

Affordable housing, which includes properties with income-restricted and/or rent-regulated units, has a few different pathways for compliance. However, there are many nuances based on the building’s affordability restrictions, and each building’s compliance pathway may significantly vary. Contact your Account Manager to discuss your properties, and they will provide guidance based on your specific building and portfolio.

What does the law say?

The law sets out a methodology for calculating carbon emissions limits for each covered building. Buildings will need to submit a report each year, prepared by a registered design professional, showing their calculated limit as well as their carbon emissions for the previous year. Buildings that emit carbon over their calculated limit are subject to a fine.

For buildings with alternate compliance options—such as buildings containing one or more rent-regulated units—there is a list of prescriptive, non-capital-intensive measures that they can perform in lieu of meeting the emissions limit. See below for that list of measures. A retro-commissioning agent must prepare and submit a report that confirms the prescriptive measures have been installed.

What date does this go into effect?

For buildings not covered under the alternate requirements, the two important submission years to know are 2024 and 2029.

In 2024, the carbon limits take effect. Starting in 2025, covered buildings will need to submit a report showing their carbon emissions in 2024. Any buildings that release carbon emissions above their calculated limit will be fined. In 2029, the permitted emissions caps are significantly lowered, in an effort to get NYC’s buildings to a carbon reduction of 40% by 2030.

Buildings containing one or more rent-regulated units, which are exempt from the emissions limits, can submit evidence of having performed the prescriptive measures required in the law instead of meeting the emissions limits.

Does a building have to make changes in order to comply?

No. The 2024 limits were designed to only cover the 20-25% highest carbon emitting buildings. About 75-80% of multifamily buildings are already in compliance for 2024.

However, if a building’s carbon emissions are above the set limits, they will at least need to make operational changes to get into compliance.

What should building owners do today?

The first thing is to know where you stand. The benchmarking data you have been submitting each year for Local Law 84/133 contains a carbon emissions calculation.* Then, compare this to your building’s carbon limits for 2024 and 2029. You can calculate your carbon limit by taking your building’s square footage and multiplying by the relevant occupancy group.

For buildings with multiple occupancy groups, if one is dominant, just use that one. If there are multiple occupancy groups with substantial square footage, then multiply the relevant square footage for each occupancy group and add them together. Any emissions over this limit would be subject to a fine of $268/ton of carbon. More on that below.

If you find yourself under both the 2024 and 2029 limits, this means, as long as you continue operating the building as you have been, you shouldn’t have anything to worry about until at least 2034.

If you find yourself under the 2024 limit but over the 2029 limit—which should be the case for most buildings—you don’t need to panic, but you should start making decisions with an eye towards that 2029 limit. Planning early will make the process easier and ensure you avoid the fine.

If you find yourself over both the 2024 and 2029 limits, still don’t panic! But understand that now is the time to put together an action plan. If you’re not sure where to begin, give us a call.

For all covered buildings, regardless of where you are today with respect to carbon emissions limits, you need to be making decisions going forward with these limits (and potential fines) in mind.

*By our estimates, that calculation tends to be about 0.5% below the calculation specified in the Climate Revitalization Act, so if you want to be extra careful, multiply this number by 1.005.

What kinds of fines can I expect if I can’t reduce my emissions below the 2024 and/or 2029 limits?

Remember, 75-80% of buildings should not have fines for 2029, as they are already in compliance. But if your building is currently over the emissions limits, you have two paths to get into compliance:

- Alternative Compliance Path: You may be so far over the limits (40% or more), you fall into the “alternative compliance path” category, in which you would need to reduce your building’s emissions by 30% over its 2018 emissions level.

- Make changes: You can plan to get below the 2024 threshold through energy conservation measures, renewable energy, and/or operations changes.

If by 2024 you are still over the limit, your fines will entirely depend on your building’s total emissions.

Fines are calculated by multiplying your emissions overages by $268. The equation is the same for both 2024 and 2029, but with a different carbon limit.

Should you find that you are in store for a future fine, take that fine into account when calculating the return on investment of future energy projects. For example, if you are subject to a $10,000 per year fine, and you are weighing the value of a potential energy project that costs $100,000 but would save you $5,000 per year in energy costs in addition to the $10,000 per year fine, you will have a much shorter payback. Not to mention, that project will have other upsides like improved tenant comfort and health.

It’s important to note that non-compliance by failing to report comes with a hefty fine and providing false reports comes with an even heftier fine (and potentially jail time).

I have to make at least some substantial improvements to get into compliance. How will I pay for them?

New York utilities have some lucrative incentive programs to help offset costs. We recommend that when you are doing cost-benefit calculations of any building improvements that impact energy use, remember to include the potential emissions fine in future operating costs. In many cases, that will make the economics of the more energy efficient improvement look more attractive. Keep in mind that if you do not make those improvements and your carbon emissions are over the limits, you will get fined.

Fannie Mae and Freddie Mac both have green financing programs, and more will come. The Community Preservation Corporation (CPC) and Bright Power launched CPC VeriFi, which allows owners to quickly explore utility savings and financing options for simple, moderate, and significant energy efficiency improvements. There are options, and there are resources. Let us know if you need help figuring it out.

What kinds of improvements will I need to make to reduce my carbon emissions?

There are lots of variables here. The good news is you have resources! We worked with Building Energy Exchange and Sustainable Energy Partnerships to analyze a massive dataset of NYC multifamily buildings to help building owners understand their improvement options. We recommend taking a look at the tearsheets to see more examples of buildings, potential impactful improvements, and their associated GHG and monetary savings. And, start looking at your most recent energy audit to see which of the more deeper energy savings measures have already been recommended for your building.

What are the prescriptive measures for rent-regulated buildings?

- Adjusting temperature set points for heat and hot water to reflect appropriate space occupancy and facility requirements

- Repairing all heating system leaks

- Maintaining the heating system, including but not limited to ensuring that system component parts are clean and in good operating condition

- Installing individual temperature controls or insulated radiator enclosures with temperature controls on all radiators

- Insulating all pipes for heating and/or hot water

- Insulating the steam system condensate tank or water tank

- Installing indoor and outdoor heating system sensors and boiler controls to allow for proper set-points

- Replacing or repairing all steam traps such that all are in working order

- Installing or upgrading steam system master venting at the ends of mains, large horizontal pipes, and tops of risers, vertical pipes branching off a main

- Upgrading lighting to comply with new standards

- Weatherizing and air sealing where appropriate, including windows and ductwork, with a focus on whole-building insulation

- Installing timers on exhaust fans

- Installing radiant barriers behind all radiators

I read the legislation, and there’s a lot of ambiguity. What does that mean?

There’s still a lot to be ironed out by the newly created office, which will oversee the implementation of the energy performance laws. There’s also an advisory board that will help the office make future decisions with regard to emissions limits beyond 2035, and for greenhouse gas coefficients after 2029.

How does this relate to building energy grades (Local Law 33/95)?

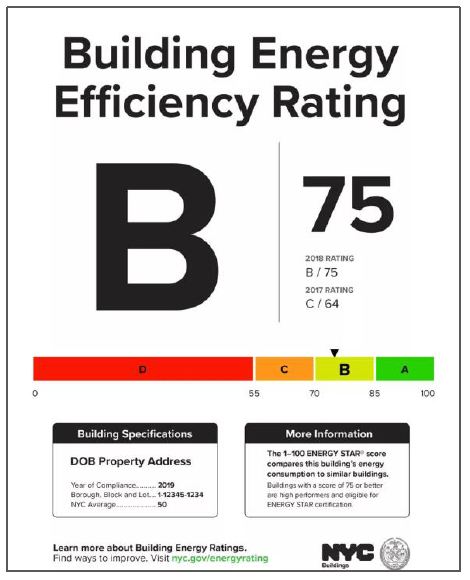

Local Law 33 is already an active New York City ordinance that requires buildings above 25,000 square feet to post an energy efficiency grade at each public entrance beginning in 2020. Similar to the Department of Health grades for restaurants, a building’s energy efficiency grade will be a letter.

However, Local Law 95 (1251-A) changed the grade distribution. City grades are determined by a building’s ENERGY STAR Portfolio Manager score, which comes from the annual energy benchmarking that is required under Local Law 84 and 133. Here is the breakdown of the new grades:

A: 85 & above

B: 70-84

C: 55-69

D: 54 & below

F: Non-compliance

N: Exempt or score not feasible to obtain*

Labels, like the sample one below, will be made available in the DOB NOW public portal on October 1. Building owners must post their building’s grade by October 31 annually. Failure to do so will result in an annual fine of $1,250. For more information on this process, read this Local Law 33/95 overview by Jeannine Altavilla Cooper, Director of Analysis, New York.

*Buildings with an N grade contain a data center, television studio, and/or a trading floor that is >10% Gross Floor Area (GFA) and are exempt from compliance.

How does this relate to other energy reporting requirements (i.e. the benchmarking required in Local Laws 84 and 133)?

Right now, they are separate. As currently written, you will still need to submit annual energy usage to Portfolio Manager for compliance with Local Laws 84 and 133, and a separate report (signed off on by a “registered professional”) for the new emission law. But we believe that management and enforcement of all these energy-related laws will be brought together under the same new “office of building energy and emissions performance,” which may streamline the reporting requirements. Whether or not the City streamlines the reporting, we plan on making the process as easy as possible for our clients. Your dedicated Energy Analyst will be able to handle both sets of reporting, and we will offer a discount for doing both benchmarking and carbon emissions compliance submissions with us.

Getting the most out of energy benchmarking is even more important with the new emissions law. Benchmarking is a powerful, strategic tool that unlocks areas of opportunity for energy and water efficiency improvements and savings across your portfolio. You can use it to get ahead of your energy performance so that you will be ready when 2024 and 2029 roll around. Need more information on energy benchmarking? Our Executive Vice President, Strategic Initiatives, Jon Braman, explains the benefits of benchmarking.

How does this relate to the energy audit and retro-commissioning law (Local Law 87)?

The best way to think about a Local Law 87 audit is that it should provide a roadmap to achieve the carbon emissions targets in Local Law 97 (formerly Int. 1253). And the retro-commissioning that is required in Local Law 87, if done right, should help capture low-cost carbon savings. While previous Local Law 87 audits may not have been as focused on identifying measures that would maximize carbon emissions reductions, you can be sure that we are re-tooling our audits to be focused on these carbon emissions targets now.

For rent-regulated buildings, there is some overlap between the prescriptive measures in Local Law 97 and the required retro-commissioning measures in Local Law 87. Regardless of your building size or occupant type, those prescriptive measures are lower cost and have an immediate impact on your building’s performance, operations, and tenant comfort.

And just because your building was designed to be high-performance doesn’t mean it can’t use a tune-up. Our Vice President, New York, David Sachs explains how Local Law 87 can help get you into compliance with Local Law 97.

Note that Local Law 87 applies to buildings 50,000 square feet or more, whereas Local Law 97 applies to buildings 25,000 square feet or more. Buildings 50,000 square feet and over are subject to both.

I’m in the process of designing a new development. What’s new that I need to take into account?

First, you need to design with minimum carbon emissions in mind, so that once your building is fully operational, it will comply with the carbon emissions limit law. But you also will need to install solar photovoltaic (PV) or a green roof as outlined in the “Green Roofs” piece of legislation (Local Laws 92 and 94)—more on that below. We recommend that you talk with your design team now about how to best integrate solar into your roof.

What does the “Green Roof” legislation (Local Laws 92 and 94) entail?

Local Laws 92 and 94 (LL92/94) require projects involving the construction, addition, or replacement of a structural roof deck to install solar PV or a green roof on all usable roof space. This includes any new construction projects, vertical and horizontal extensions, and projects with major modifications to an existing building’s roof that requires a permit. Buildings that cannot accommodate a minimum of 4 kW solar PV or 200 square feet of green roof (Group R buildings with five stories or less have a different minimum requirement of 100 square feet of solar PV/green roof) may be eligible for an exemption. If you are unable to install solar PV, you must install a green roof. Standard roof replacement projects involving a new roof membrane or insulation are not required to comply with LL92/94.

The legislation supports what we advise our clients: maximize the roof’s potential and put as much solar as you can up there. There are many options, from more conventional solar installations, like ballasted, tilted plane, or pergola systems on existing buildings and new developments—see Arverne View, Dumont Green, Marcus Garvey, and The Apartments at Landing Road—to solar as an innovative and beautiful design feature—see St. Augustine Terrace, The Meekerman, and Via Verde. We are happy to work through the options with you.